Active Member FAQs

Refer to our Active Member FAQs for answers to many common questions.

Contact Us

[email protected]

-

- If I teach full time, do I have to join NYSTRS?

You must join NYSTRS if you are employed by a New York State (excluding New York City) public school district or BOCES or a NYSTRS-participating charter school in a full-time position as a teacher, teaching assistant, guidance counselor, educational administrator or other title covered by NYSTRS.

You may join NYSTRS if you are employed in a New York State community college or SUNY, where you have the option of joining the New York State and Local Employees’ Retirement System or an Optional Retirement Plan instead of NYSTRS.

If you were hired on or after July 1, 2013 with estimated annual wages of $75,000 or more and you are not a member of a NYSUT bargaining unit, you may join either NYSTRS or the Optional Retirement Plan.

- If I teach part time or I am a substitute teacher, am I eligible to join NYSTRS?

Yes, you may join NYSTRS if you are employed less than full time in a NYSTRS-eligible position. Inform your employer that you wish to join and submit an Application for Membership (NET-2) to your employer. Your employer must deduct NYSTRS contributions from your pay as required by law.

- What are membership tiers and how do I know which one I am in?

Membership tiers refer to groups of members whose benefits are determined by different laws and regulations. There are six membership tiers in New York State based on date of membership. Your tier and date of membership are listed in your annual Benefit Profile. Those joining a state retirement system for the first time will be Tier 6 members. See the Active Members’ Handbook for a description of all tiers.

- I had a previous membership in a NYS public retirement system. How will that affect my membership with NYSTRS?

If you had a previous membership in NYSTRS or any other New York State public retirement system, you are eligible to reinstate to your earlier date of membership. You may be able to receive the service credited under that membership along with any possible advantages of an earlier tier. However, you may also need to repay, in a lump sum with interest, the amount refunded from your previous membership.

To apply for reinstatement, you must file an Election to Reinstate (RIS-1) form with NYSTRS. It currently takes about 12 months to process a reinstatement request.

If you are eligible to purchase credit for prior service in addition to being reinstated to a former membership, the timing of your actions may be important. Speak with a NYSTRS Information Representative before filing any paperwork by calling 800-348-7298, ext. 6250.

- I have an active membership in another NYS public retirement system. Can I transfer that membership to NYSTRS?

You can have memberships in more than one NYS retirement system and receive benefits from both. However, if you no longer work in a job reportable to the other system, it may be beneficial for you to transfer your membership from the other system to NYSTRS. Your service credit, member contributions (if any), and original membership date may all be transferable to NYSTRS.

It is also possible to transfer from NYSTRS to the other system if you have stopped working in a position reportable to NYSTRS.

Before deciding on a transfer, you should contact both retirement systems to discuss how a transfer could affect your benefits.

- If I teach full time, do I have to join NYSTRS?

-

- Am I required to make contributions to NYSTRS?

As mandated by New York State law, Tier 3 and 4 members made pension contributions of 3% of their salary until they had either 10 years of membership or 10 years of service credit. Tier 5 members must make pension contributions of 3.5% of their salary throughout their active membership. Tier 6 members contribute 3-6% of their salary based on the amount of their salary. (See Contribution Rate Information for Tier 6 Members.)

Member contributions help fund your pension. If you leave service and withdraw your membership, the contributions you made (plus 5% interest) are refunded to you.

- What is my contribution rate?

Log in to MyNYSTRS to see your contribution rate.

- Can I borrow against my contributions?

Members may borrow only from the funds they have contributed to NYSTRS and the interest on those contributions, not from the funds their employers contributed. Before deciding whether to borrow from these funds, watch our video “Loan Truths…and Consequences” and review our Loan Taxability tutorial.

Members who joined the System on or after July 1, 2022 may borrow up to 50% of their total contribution balance or $50,000, whichever is less. Members who joined the System prior to July 1, 2022 may borrow up to 75% of their total contribution balance.

Tier 1 and 2 members generally do not make contributions to the System and therefore most are not eligible to take loans from the System. Only Tier 1 and 2 members who have an Annuity Savings Fund (ASF) containing a minimum of $400 are eligible for loans.

Tier 3-6 members must have an active NYSTRS membership with at least one year of service credit. Members who joined prior to July 1, 2022 must have at least $1,334 in required contributions to be eligible to apply for a loan; members who joined on or after July 1, 2022 must have a minimum of $2,000. New loans include 5.95% interest, a $30 service charge and an annual life insurance premium of 0.10%.

If you have a MyNYSTRS account, you can obtain a loan estimate and apply for a loan online. See the Active Members’ Handbook for details on loans or call us at 800-348-7298, ext. 6080.

- I’m a Tier 6 member and I work for multiple employers. How is my contribution rate determined?

For your first three years of employment (when rates are based on projected earnings) your contribution rate for each of those school years will be established using the projected salary from the first of your employers to report salary information to NYSTRS. Beginning in the fourth year, your contribution rate will be based on the total actual earnings you received two years prior. This method for determining Tier 6 contribution rates is set in statute.

For more detail, see Contribution Rate Information for Tier 6 Members (MES-4).

- Am I required to make contributions to NYSTRS?

-

- How do I earn service credit?

You will be credited with one year of service if you work the equivalent of at least 170 full-time days during the regular school year. You cannot be credited with more than one year of service in a school year, even if you earn extra salary for other responsibilities such as coaching or teaching summer school.

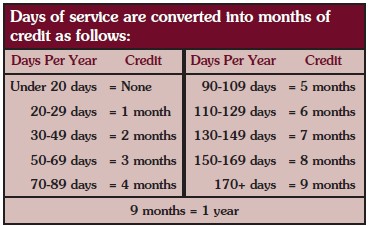

You can also receive credit for part-time and substitute teaching within a school year if you work at least the equivalent of 20 full days. Days worked in different school districts in the same school year are combined to determine your total credit. Days of service are converted into months of credit. For example, if you worked 60 days filling in for someone on medical leave, you would earn three months of credit. If you substituted 30 days within a school year, you would receive two months of credit. (See chart)

To learn about other ways to accumulate service credit, see our publication You Deserve the Credit.

- I worked for a NYS public employer before joining NYSTRS. Can I receive credit for that service?

Yes, you can receive credit for prior service that was credited (or would have been creditable) in any NYS or NYC public retirement system. However, you need to apply for prior service credit and pay NYSTRS the appropriate cost based on your tier. See our publication You Deserve the Credit for details.

Prior service can be credited once you have at least two years of service credit in your current NYSTRS membership.

- How can I apply for prior service credit?

You must submit to NYSTRS a Prior Service Claim (PRS-2) form. In addition, you must complete Part 1 of the appropriate prior service verification form and send it to your former employer. Your former employer must complete Part 2 of the form and return it to NYSTRS.

MyNYSTRS account holders have the convenience of submitting and tracking their prior service claim online. Provided you did not receive credit for this service under an earlier membership, upon submitting the claim online you will be directed to print the applicable verification of salary and service form.

It takes about six to eight months from the receipt of all necessary documentation to fully process a claim.

- Can I receive credit for private school teaching?

No, there is no provision in the law that allows a NYSTRS member to receive credit for private school or federal employment. Service in Armed Forces dependent schools is also not creditable.

- Can I receive credit for my military service?

Yes, you can receive credit for active military duty that preceded your NYSTRS membership or that interrupted your NYSTRS membership. Honorable discharge documentation is required as verification of military service and there are limits to how much credit you can receive. Contact NYSTRS for more information and review our publication Claiming Military Service for details.

- I’m a Tier 6 member and I work for multiple employers. How is my service credit calculated?

NYSTRS will collect and process service information from all your employers for each school year. In all cases, you may not receive more than one year of service credit per school year (July 1 – June 30), even if your combined service totals more than 200 days.

Note: If you work full time for one of your employers, your earnings and service credit would be limited to your two jobs with the highest earnings.

For more detail, see Contribution Rate Information for Tier 6 Members (MES-4).

- How do I earn service credit?

-

- What does it mean to be vested?

Members vest when they attain a certain amount of New York State service credit. This generally makes them eligible for a retirement benefit as early as age 55.

Tier 1-6 members all vest with five years of state service credit. (Prior to April 9, 2022, Tier 5 and 6 members needed to attain 10 years of state service credit to be vested.)

- What happens if I leave teaching before I vest?

If you leave teaching before you vest and do not intend to return to service, you should withdraw your member contributions plus interest and cancel your membership. Do so by filing an Application for Withdrawal from Membership (REF-7A). Please note you would not be eligible to receive contributions made on your behalf by your employer(s).

If you later return to teaching, you may reinstate your former membership under your former tier. Alternatively, you can keep your NYSTRS membership active by working the equivalent of 20 full-time days in a school year for a NYSTRS-participating employer at least every seven years.

If you left teaching for other NYS public employment reportable to a different retirement system, you may want to consider transferring your NYSTRS membership to the other system. Your service credit, member contributions (if any), and original membership date may all be transferable. However, before deciding you should contact both retirement systems to discuss how a transfer could affect your benefits.

- What happens if I leave teaching after I vest?

If you have at least five years of service credit and you maintain your membership, your membership is vested and you will be eligible for a service retirement benefit in most cases at age 55. (Vested Tier 6 members with an inactive membership must be at least 63 to retire.)

There are some limited situations in which a vested member may withdraw membership and receive a refund of required contributions they made. See the Active Members’ Handbook for details or call NYSTRS at 800-348-7298, ext. 6090.

If you are now working in a position reportable to another NYS retirement system, you may want to transfer your NYSTRS membership to the other system. Your service credit, member contributions (if any), and original membership date may all be transferable. Before deciding on a transfer, you should contact both retirement systems to discuss how a transfer could affect your benefits.

- What does it mean to be vested?

-

- When will I be eligible to retire?

Tier 1-6 members in active service may generally retire at age 55 with five years of New York State service credit. See the Active Members’ Handbook for details.

- How is the amount of my pension calculated?

Your pension is based on your years of service, final average salary, your age, and your membership tier. See the Active Members’ Handbook for details and examples.

- How can I change my address?

You can change your address online through your MyNYSTRS account, by filing a Member Name/Address Change (GRE-50) form, or by sending NYSTRS a signed letter that states your new address and your EmplID or Social Security number. The form or letter may be mailed to NYSTRS at 10 Corporate Woods Drive, Albany, NY 12211, or faxed to 518-447-4749.

- My name has changed. What should I do?

To change your name, complete the Member Name/Address Change (GRE-50) form and either mail it to NYSTRS at 10 Corporate Woods Drive, Albany, NY 12211, or fax it to 518-447-4749.

The following documentation must be included with this form to change your name:

- A photocopy of your marriage certificate, court order or divorce decree stating legal change of name.

- A photocopy of your valid driver’s license, passport, military ID or Social Security card issued under your new name.

- What should I do if I am no longer able to work due to a disability?

If you are no longer able to work because of a serious illness or injury, you should contact NYSTRS immediately at 800-348-7298, ext. 6010 to receive disability retirement information and an updated benefit estimate. Also see our publication If You Are No Longer Able to Work and the Active Members’ Handbook for details.

- Will my beneficiaries receive a death benefit if I pass away prior to retirement?

Yes, in most cases. If you are a Tier 1 member, the in-service death benefit is generally 1/12th of your last 12 months of regular compensation for each year of service to a maximum of three times earnings.

If you are a Tier 2-6 member, the in-service death benefit, known as the Paragraph 2 death benefit, is generally one year’s salary after a year of service, two years’ salary after two years, and three years’ salary after three or more years. There is a cap on the maximum amount of salary considered for calculating the death benefit. Review your Benefit Profile, available online to those with a MyNYSTRS account, for the amount specific to you.

See the Active Members’ Handbook for details on other death benefit coverage that may apply (e.g., post-retirement, vested, accidental, and accelerated).

You may change your beneficiary designation(s) prior to retirement by using the Beneficiaries tab under My Retirement in your secure MyNYSTRS account or by filing a notarized paper form Designation of Beneficiary For In-Service or Post-Retirement Paragraph 2 Death Benefit (NET-11.4).

Instances in which a death benefit likely would not be payable include:

- The member was not vested and had little to no service in the year prior to passing.

- The member worked for a non-participating employer of NYSTRS, such as a charter school that elected not to participate in NYSTRS.

Beneficiaries unsure of their eligibility for a death benefit should contact NYSTRS at 800-348-7298, ext. 6110.

- When will I be eligible to retire?